A new breed of bank has been shaking up the financial sector and is forcing everyone to play catch-up. The so-called challenger banks have been redefining banking with their focus on making services easy, convenient and even enjoyable to use. Fintech start-ups like Monzo, Metro and Starling have been chipping away at the dominance of traditional banks by leveraging financial technology.

What is Fintech?

Fintech is the catch-all term for any company that uses technology to provide financial services. It’s the tech that allows you to transfer money between bank accounts while enjoying your latte on the go, plug your overdraft at 3am or use your smartwatch to make a contactless payment instead of using cash.

Customer experience is everything

But it’s not just about technology. It’s also about values. For these start-ups, the customer experience is everything. Their services have been designed from the bottom up by first understanding what customers want. They’re customer-centric by design.

They have an advantage over incumbents like Barclays, Lloyds, HSBC and RBS, the banking sector’s Big Four. They’re lean, flexible and driven by innovation. They’re unburdened by legacy systems, bricks and mortar, and inherited business practices.

This makes them very adaptable to challenges, Matt argues in a webinar on designing for change in the ever-evolving financial space. Products and services are constantly being improved in response to customer feedback, new technology and global events, like a pandemic for example.

Digital creatives are shaping the future of digital banking

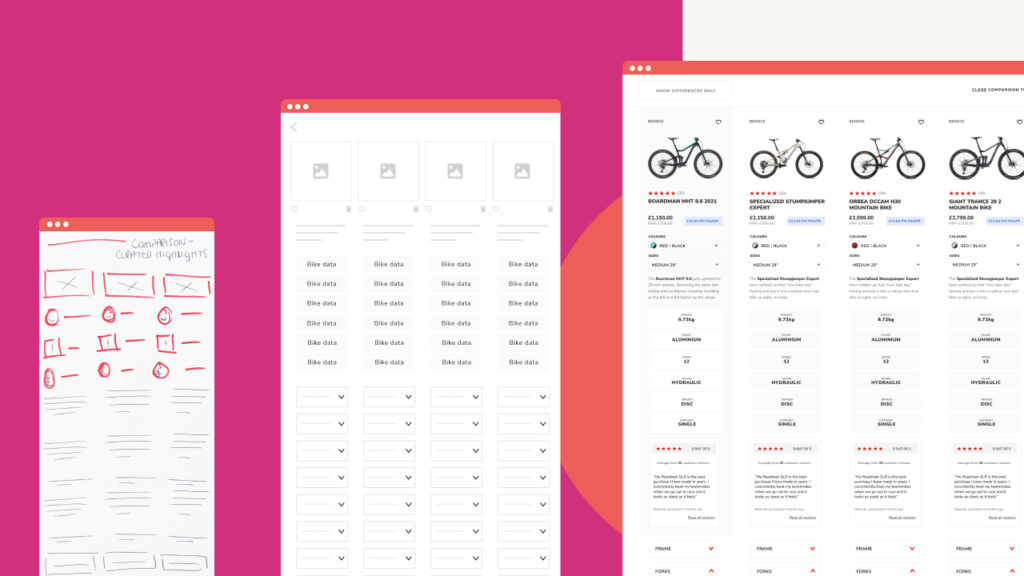

They do this by working in small, self-contained multidisciplinary teams. They work closely together to solve problems and make decisions quickly. These product teams are constantly testing their products with their audience. They follow a “build, test and iterate” design approach to keep improving.

Who are the new wolves of Wall Street leading this banking revolution? They are user researchers, experience designers and programmers. These “digital creatives” are shaping the future of digital banking, says Matt. They are collaborative, agile and driven by data. But most of all, they are user-centric.

This focus on user experience, coupled with new technology, has opened financial services to a new group of consumers, who may have previously felt the stock market was just for the Gordon Gekkos of this world. Trading platforms like Trading212, Robinhood and eToro want to make buying stocks and shares as easy as buying milk and bread.

Will Fintech kill traditional banking?

But in this competitive arena, there’s no time to stand and stare. Businesses need to evolve or die. Suddenly, Starling Bank, Revolut and friends are already looking over their shoulder as a new wave of banking apps, like Allica Bank, Glint and Hyperjar, is set to change it up again with a stronger focus on niche markets.

The price of entering this once exclusive sector continues to fall thanks to technological advances such as ready-made banking technology, known as ‘banking as a service’. This has allowed consumer Fintechs to outsource their tech layer and to set themselves up cheaper and faster than their predecessors. Firms such as ClearBank, Railsbank and Solarisbank have been renting out their core banking infrastructure, allowing neo-banks to focus their energy on designing the end service.

So what does this all mean for traditional banks? No one’s reading their last rites just yet. They’re still the heavyweights in this arena but they’ve been trying hard to get a bit leaner by investing heavily in digital. But the closure of RBS’s digital-only bank Bo after only six months shows that it’s not that simple. It’s not just a question of parachuting a multi-disciplinary agile team into a department and expecting things to change overnight.

Make the user experience your competitive differentiator

Introducing human-centred design requires a cultural change which takes time to embed itself. There are old ways of doing things, legacy systems and pockets of resistance to contend with. To be successful, this new model needs to be supported and driven by senior leaders.

We’ve championed the value of user-centred design through our work with financial sector clients, including Virgin Money, Nimbl, Permanent TSB and Development Bank Wales.

Designing Virgin Money’s credit card app

Our user researchers played a key role in helping Virgin Money’s new credit card app stand out by applying our unique approach to UX blending robust research, empathy and behavioural psychology.

We worked with users throughout the project to test prototypes and gather insights that fed into the design process. The first three months of the launch of the app showed a 10-point upward swing in the Net Promoter Score.

Susan Liu, Head of Design Research at Virgin Money, said Nomensa had “played a pivotal role in Virgin Money’s digital design process towards delivering our first consumer mobile banking app.”

Designing for change is about having a culture, team and process in place to keep evolving. To discover how you can set up a design team to create successful user-centred products, watch Matt’s webinar ‘Designing for change in the ever-evolving financial space’.

Or better yet, get in touch with our team of user experience experts. We help transform bank and Fintech capability by matching inclusive design with commercial understanding, revealing opportunities for better integration, innovation and market disruption.

Email us at hello@nomensa.com or give us call on +44 (0) 117 929 7333 to find out more.

We drive commercial value for our clients by creating experiences that engage and delight the people they touch.

Email us:

hello@nomensa.com

Call us:

+44 (0) 117 929 7333